Hotel Management Agreements (Part-2)

- Harun Dagli

- Dec 3, 2018

- 11 min read

This is the second article on “Hotel Management Agreements”, the first article lay the foundations and provide brief information on available options on the market. In the next couple of articles, I will review most used/popular agreements and compare them accordingly.

When a hotel owner decides to bring in a management or operating company to run its hotel business then the main concern will be to find one that has the correct "fit" for the hotel. There are several quality hotel operators in the market and therefore, a well-established track record in similar hotels, expertise in key areas and a competitive fee structure will be important considerations during the research.

Management contract: Agreement between hotel owners and hotel management company under which, for a fee, the management company operates the hotel.

To give you an idea, below-highlighted areas managed by the operator under a management contract:

The overall operation of the hotel according to the company and brand standards.

The day-to-day running of the business.

Hotel administration.

The performance of managers and employees including training and employment.

Secure, and if it has closed, reopen the hotel

Implement sales and marketing plans to maximize the hotel’s short & long-term profitability

Generate reliable financial statements

Establish suitable staffing to maximize customer and employee satisfaction

Show hotel to prospective buyers

Report regularly to owners about the hotel’s condition

Manage/directing major renovation of the hotel

It is important to examine the management company to understand whether it’s fit for the hotel, owners and business. Therefore, there are simple criteria’s you need to check; are they first or second tier management company, the number of hotels they operate, they of engagements they are in other establishments?

Once you reduce down to a couple of potential operators then you need to enter negotiation stages with several of them to find the right fit. Management companies have detailed agreement templates and as you can expect, all design to protect operating company for all eventualities. Of course, it is negotiable and we will highlight the key issues you need to be aware and even though these issues are not exhaustive, we would suggest getting professional advice should be sought in each case.

Negotiating a well-structured and customised Hotel Management Agreement should bring benefits to both the owner and operator of a hotel by clearly setting out roles and responsibilities and flushing out any areas of potential dispute at an early stage.

Major Elements of a typical Management Agreement Include;

Length of the agreement (on average Brand operators 17.4, Independent operators 11.3 years) *Source HVS Research

Procedures for early termination by either party

Procedures for extending the contract

Contract terms in the event of a hotel’s sale

A base fee (usually a percentage of gross revenues)

Management/Incentive fee (based on a percentage of -adjusted- gross operating profit) or penalties assessed related to operating performance

Marketing fee (based on rooms revenue)

Management company investment required or ownership attained

Reservation fee (based on the number of reservations made)

Reporting relationships and requirements

Insurance requirements of the management company

Status of employees

Let’s review them in detail;

The Term, Renewal periods and Exit

The initial term of a Hotel Management Agreement will vary from case to case, often due to the respective bargaining positions of the parties. Operators, particularly branded operators will generally look for, and be able to secure, a longer initial period; citing the investment made by the operator in establishing the reputation of the hotel and the need to ensure that their brand reputation and income flow is not compromised if replaced within a short period of time.

Owners typically prefer to avoid being bound for the long term, particularly as it is unusual for owners to be entitled to terminate a management agreement at its discretion without paying a significant compensation amount to the operator. Owners will also not want the operator to have specific renewal rights, or for any rights of renewal being subject to certain performance conditions, on the basis that if the hotel is a success, renewal will be in both parties’ interests.

Additional commercial arrangements can be agreed to balance the interests of the parties;

The long initial period should be fine as long as the fees properly reflect any unusually long initial period. However, in the case of underperforming operator owners should seek to impose termination rights based on a performance test under which the owner may terminate should the hotel fail to perform at a required/agreed level. Owners may also seek to link the payment of fees to the operator to the performance of hotel using incentive fees.

Renewal periods (e.g. for subsequent 5-year periods) are commonly set out in the Agreement, although will usually require both sides to agree on the renewal at the relevant time.

Owners should also be careful that the Agreement does not frustrate their ability to exit should a suitable opportunity arise. The processes for allowing such exits can require detailed negotiation and drafting to ensure that both parties are comfortable with the position.

Fees

One of the most important controls is ensuring that the fee structure is correct. The Agreement should have clear and achievable commercial incentives so that both parties are pulling in the same direction.

The fees can be put into three broad categories:

A fixed fee or one based on a percentage of turnover;

An incentive fee based upon the profit of the business;

Other additional fees relating to e.g. sales, marketing services, reservation systems, centralised services fees and certain licences.

Base Fee

From the operator’s perspective, the base fee is the minimum compensation expected for managing and generating revenue for the hotel and does not take into account the expenses associated with the operation of the hotel. This fee provides operators with some comfort that a certain level of return may be achieved when agreeing to manage a hotel.

Owners on the other side need to ensure that the level of fees charged by the operator will allow the owner to have a sufficient return on investment, and should focus on ensuring that the main remuneration of the operator is calculated on the basis of gross operating profit, which will incentivise the operator to manage the hotel efficiently and generate profit. Therefore, it is best for the owners to push down base fees and focus on incentive fees based on operating profit.

There should be mutual agreement and understanding of how the revenue and operating profit calculated as these are the basis of how the fees are calculated. There are several methods used and depending on the preference, total fees could be different for the same hotel. E.g. Should any below the line costs be taken in to account when calculating gross operating profit?

Negotiating fees is a give and take process – an owner who intends to hold a prime hotel asset in the long term and agrees that any incoming owner is bound by the hotel management agreement may be in a position to push for lower fees. Alternatively, an owner who only wishes to hold the hotel in the short term (mainly investment funds who wants to invest, improve and sell in a short period of time) and requires flexibility on the continuation of the hotel management agreement on sale, may agree to payment of higher fees in return for such flexibility.

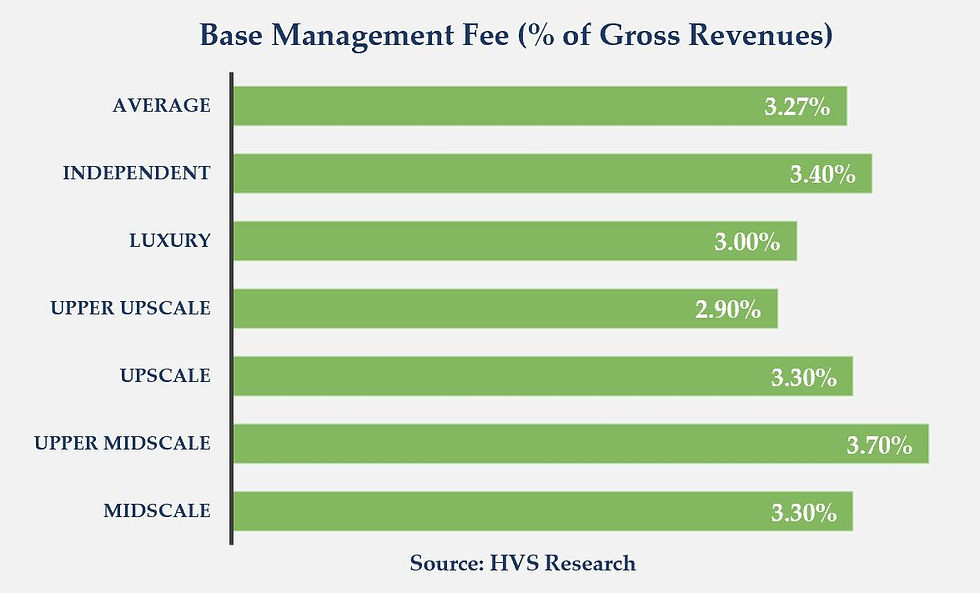

The base fee is almost always a percentage of gross revenues (F&B, leases, rooms and other). This model is the industry standard as it offers an incentive for the hotel operator to perform at its best. Average fees widely from scale and operator, in general; Brand Operators: 3.8% and Independent Operators: 2.95%.

Some of the established brand operators increase this number after the second year and raising it to upwards of 6 or 7% by the third year. Smaller properties tend to have a higher base fee and larger hotels (over 350 rooms) typically would receive a lower base fee.

Incentive Fee

The incentive fee is based on operating profit, meaning that this fee will take into account certain above the line expenses, such as operating expenses, which means that an operator who manages costs efficiently will be rewarded with a greater incentive fee. Operators will be wary of including any below the line costs, over which the operator has no control (such as FF&E reserve and property taxes) in the calculation of fees paid to the operator.

Owners can require that the incentive fees be paid on a sliding scale basis (i.e. the higher the profit the higher the fee paid to the operator to push the operator to increase profit) and may also consider requiring the payment of an owner’s return (or priority payment), that is a minimum level of return, prior to payment of incentive fees to the operator. Owners should ensure that any tender or proposal invited from operators requires the operator to identify all of the fees that it intends to charge in relation to the hotel (both at pre-opening and post-opening) and the basis of their calculation (including the relevant accounting standards intended to be used) to ensure that no later “hidden” fees appear in the hotel management agreement which could reduce the owner’s return on investment.

Incentive fees sit alongside the fixed fee arrangement but will be more detailed. They can take many forms and be based upon different measures of profit (often Adjusted Gross Operating Profit or a form of Net Operating Profit). The percentage of such fees may also rise during the term of the Agreement if there is appropriate commercial justification for doing so. The detail of the drafting is clearly important and the calculations and definitions should be carefully checked, e.g. to ensure that they properly allocate which costs are operating costs and which are ownership costs.

These incentive fees vary widely from operator to operator and can be negotiated in the contract. Some include:

Cash Flow after Owner’s Priority:

The management company receives a percentage (typically 15%-30%) of operating profit in excess of the owner’s priority, or return on investment.

Operating Cash Flow (Income before Income Taxes):

Includes a percentage (typically 10% – 20%) of the operating cash flow after deducting an owner’s priority (and funds deposited into the reserve for replacement).

Gross Operating Profit over Incentive Fee Threshold:

Includes a percentage (typically 10% – 20%) of the gross operating profit, or other defined “profit” over a specified dollar amount known as the incentive fee threshold.

Positive Variance from Budget:

A percentage of the amount by which gross operating profit exceeds the budgeted gross operating profit for the year.

Positive Variance from Prior Operator:

In this case, a profit line in the baseline year (sometimes an average of several), before the management company assumed management would be established. The operator would then receive an incentive equal to a percentage of the amount by which their future year profits exceed the baseline amount.

Other Additional Fees

Often brand operators have a long list of other expenses that are non-negotiable. An independent hotel operator wouldn’t normally charge for all of the below or that line item would be handled at the property level.

Group Marketing Fee: Typically a percentage of room revenue. This range from 1% to 3% depending on the strength of the brand you are looking to use. Basically, you are paying for that brand’s market expansion in hopes it brings more bookings to your property.

Accounting Fee: $5 – $25 per room per month when centralized accounting is used.

Project Management Fee: Sometimes it is more cost effective to have a management company act as project manager for renovation projects. This will typically cost 10-30% of the cost of the project. The higher the number, the smaller the project.

Reservation Fee: Generally, $10 per booking depending on the way booking are made on the property level.

Technology Fees: Depending on what is used and varies from company to company. This includes Cloud services, individual email addresses, specific hardware and software as well as their maintenance and upgrades.

We would like to highlight that some brand operators use a generic line such as “services contribution fee”, we would suggest questioning this line to see if there is any reasonable justification for it.

Guarantees

Sometimes operators still offer to guarantee a certain level of profit. While this may seem attractive to an owner, the terms of it should be carefully considered as often a higher fee is attached to such a guarantee.

Control and Key Performance Indicators

Two of the main purposes of the Agreement are clearly to free up the owner from the running of the business and provide the operator with the rights, powers and authorities it needs to make a success of the business. However, those rights should not be unchecked and an owner should always look to build in appropriate protections.

Those protections can vary depending upon the nature of the hotel's business but will typically include:

A budget approval mechanism, with clear resolution procedures if the budget cannot be agreed

Review meetings at appropriately regular intervals

A sensible process for agreeing on the accounts of the business (which will be particularly important for calculating the fees as mentioned in the Fee’s section)

Protections against certain types of loss, where this has been caused by the owner

A list of reserved matters that require the owner's consent (while not interfering with the operator's day to day running of the business) such as recruitment of a GM or key personnel.

Additionally, KPI's are often included to help measure, evaluate and control the operator's performance. In particularly serious situations, KPI's can be used by the owner to remove an underperforming operator. However, it is important that such termination rights are very carefully drafted to ensure they are practical and do not harm the underlying business.

Third party issues

A Hotel Management Agreement should not be considered in isolation. Frequently, Leases and Franchise Agreements, as well as other funding and commercial agreements, will be involved and the Hotel Management Agreement should appropriately dovetail with them. Such agreements should also be checked for any relevant consents that may be required (and the obtaining of those worked into the timescale of the operator commencing its management of the business).

Non-Competition

An owner will usually want some comfort that a competing hotel operated by the operator's group will not be opened in close proximity to its own hotel. That general principle may be acceptable but operators will be keen to ensure that it still has flexibility and, for example, that such a restriction does not interfere with any of its other brands which are not true competitors (e.g. budget as opposed to higher end brands). Other facts, particularly the hotel's location, will also impact upon the scope of such non-competition provisions.

Other Considerations

Knowing the exit strategy for your real estate deal is important and the Hotel Management Agreement can be a hurdle to selling. Some clauses let owners out of the management agreement for a percentage of the sale of the property or termination fee and others make it impossible to leave. Look for details like “During the Term, the Hotel may not be sold to a competitor of the brand” that may limit your ability to sell. A termination fee is usually reflective on historic base and incentive fees over a period of time (12-36 months).

For development projects, there could be a fixed monthly pre-opening fee or some companies will offer a flat technical services agreement. The price ranges widely and is defined by the responsibility of the hotel management company.

Advantages / Disadvantages of Hotel Management Agreements for Hotel Owners

1.Advantages:

Management quality can be improved

Targeted expertise can be obtained

Documented managerial effectiveness is available

Payment for services can be tied to performance

Partnership opportunities are enhanced

2.Disadvantages:

The owner cannot control the selection of the on-site GM & other high-level managers

Talented managers leave frequently

The interests of hotel owners and the management companies they employee sometimes conflict

The costs of management company errors are borne by the owner

Transfer of ownership may be complicated. The high cost of buyout limits the number of potential buyers

The content of this article is a compilation of our first-hand experience, several well-known books, industry related articles as well as research reports. Our intention to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

This is the second part of Hotel Management Agreements series article; the third one will be focusing on “Franchise Agreements”.

We hope you find this article useful. Please feel free to contact us to get advice, assess your property needs and help to optimise the usage of the hotel's physical and human assets to achieve superior standards of service and deliver maximum value to owners and investors within agreed profit objectives. You can reach us either Contact tab on my website or via email directly on harundagli@hospitalitycode.com to arrange a private chat.

If you are passionate about the hospitality and the subjects I have shared, come and check out our blog on www.hospitalitycode.com, or take advantage of our one-and-done subscription to get articles delivered in real-time to your inbox.

Comments